Did you know that 77% of banking executives believe AI holds the key to their success—and that over half of industry leaders are already capitalizing on AI’s potential? Within three years, GenAI use cases are projected to deliver a 9% reduction in costs and a 9% increase in sales. Meanwhile, 4 in 10 individuals already see AI as a tool to manage their finances, and over half say they’re willing to adopt it if it eases money worries. Notably, one-third of those who’ve tried this technology would trust it more than a human to handle their assets.

Forward-looking companies like Morgan Stanley are already putting AI to work with internal chatbots. Using OpenAI’s GPT-4, Morgan Stanley’s assistant searches wealth management content to simplify access to crucial information—making it more practical for the company.

Eager to see how other financial institutions are driving advancements? Explore examples of how Generative AI in banking is transforming the landscape, along with strategic insights to realize its maximum impact for your organization.

SECTION: The Strategic Benefits of Generative AI in Banking

• Elevated customer interactions: More natural, human-like conversations deepen engagement and personalization, boosting satisfaction, loyalty, and lifetime value.

• Breaking language barriers: Multilingual support expands reach to a global clientele and fosters inclusivity.

• Unlocking revenue potential: Analysis of customer data, transactions, and market trends enables targeted products, personalized offers, and optimized pricing.

• Real-time risk mitigation: Pattern learning helps identify anomalies and fraud, safeguarding institutions and customers.

• Streamlined operations: Automation reduces manual, time-consuming tasks and optimizes resources to lower costs.

• Effortless compliance: Automated checks and reporting aid adherence to standards and reduce burden on compliance teams.

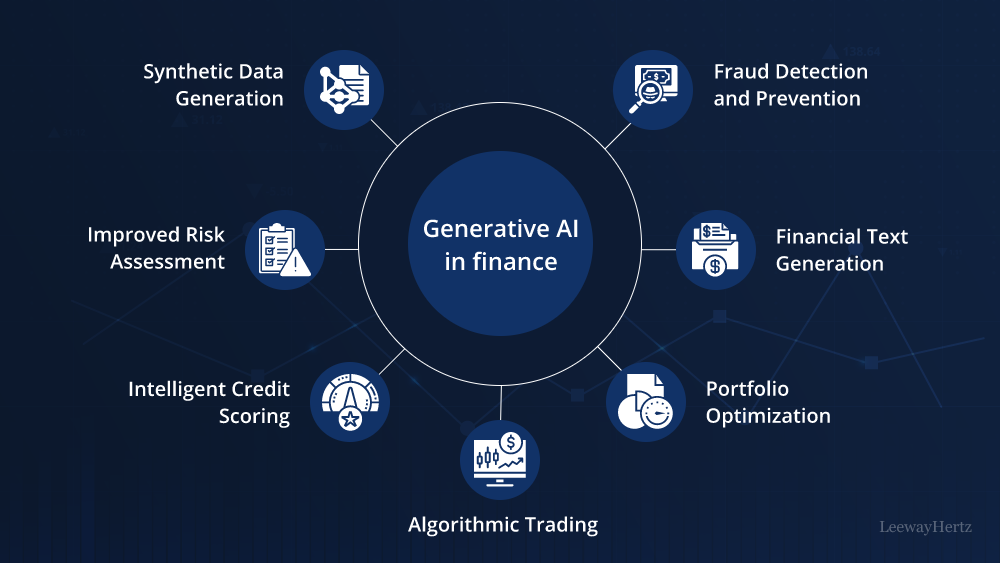

SECTION: Generative AI Use Cases in Banking

Customer Service

AI transforms support into a 24/7, multilingual, and emotionally intelligent experience. Generative systems deliver instant, human-like assistance for routine inquiries and route complex cases with full context—elevating satisfaction and simplifying operations.

Fraud Detection and Prevention

Trained on historical fraud patterns and continuously monitoring transactions, GenAI pinpoints unusual behavior and notifies clients. Examples:

• Behavioral biometrics to detect anomalies in user interactions.

• Real-time transaction monitoring to flag suspicious activity.

• Anomaly detection in large datasets to uncover hidden, complex fraud schemes.

As Natalie Faulkner (KPMG) notes, banks must be agile and embrace technologies that predict and prevent fraud—GenAI offers a proactive, adaptive solution.

Credit Approvals & Credit Scoring Questions

Intelligent FAQ chatbots answer “What is credit scoring?” and “How to boost creditworthiness?” Beyond FAQs, GenAI can analyze earnings, employment, and credit history to support faster, fairer decisions.

Loan Application

By rapidly examining diverse financial data, AI models provide an exhaustive borrower profile. Lenders can tailor terms and interest rates and run simulations under varying economic conditions—making lending safer, more efficient, and transparent.

Personalized Financial Advice

While ~70% of banking leaders say personalization is critical, only ~14% of consumers feel banks excel at it. GenAI bridges this gap by aligning recommendations with customer objectives and risk appetite, using market trends and forecasts to keep advice current.

Risk Assessment

AI enhances risk modeling and forecasting by analyzing historical data, market conditions, and user profiles. It dynamically assesses creditworthiness, liquidity risks, and market volatility to inform underwriting and strategy.

Transaction Monitoring

With continuous learning, GenAI detects irregular patterns in real time, adapts to emerging tactics, and reduces false positives—protecting assets and improving efficiency.

Financial Literacy

Conversational systems support multilingual education, explaining financial concepts and product usage in clear, accessible language to improve client understanding.

Credit Card Recommendation

GenAI personalizes card recommendations based on spending habits, goals, and lifestyle, compares features, and guides applications—improving satisfaction and decision quality.

Debt Collections

AI boosts engagement with tailored, empathetic messaging that raises repayment rates and reduces hostility. It predicts responses and adapts strategies in real time while maintaining compliance.

Conversationalizing Mathematics

GenAI makes complex calculations accessible in natural language, e.g.:

• “If I invest $X at Y% for Z years, what’s my return?”

• “What’s the difference in monthly mortgage payments at variable X% vs fixed Y%?”

This reduces jargon and improves clarity across payments, investments, and mortgages.

Financial Recommendations

GenAI can recommend savings and budgeting actions (e.g., automating transfers per paycheck, alerts at spend thresholds) to strengthen financial habits and outcomes.

Augmenting Employee Workflows

Automation removes repetitive tasks and supplies real-time insights, improving decision speed and quality. Personalized training modules accelerate skill development and productivity.

Automated Report Generation

AI compiles regulatory, financial, and operational reports—pulling data, drafting narratives, and ensuring formatting compliance to save time and reduce errors.

AML Compliance

GenAI cross-references transactions with global watchlists, detects layered concealment tactics, and drafts detailed SARs—enabling proactive compliance and reduced regulatory exposure.

SECTION: Advanced Generative AI Banking Solutions

Generative AI Banking Chatbots

Modern assistants engage in fluid, context-aware conversations, guide account management and loan applications, and deliver personalized service at scale.

Generative AI in Investment Banking

Analysts use AI to sift data, surface patterns, streamline complex risk assessments, and generate detailed models and forecasts—improving insight, efficiency, and outcomes.

GenAI Use Cases in Retail Banking

24/7 virtual assistants handle inquiries and guidance tailored to individual goals, while back-office optimization reduces costs and errors.

Generative AI Copilots for Banking Teams

Copilots summarize documents, autocomplete forms, retrieve data, and surface insights during live conversations—lowering cognitive load and improving productivity.

SECTION: 11 Examples of Financial Institutions Using Generative AI

• Wells Fargo — “Fargo” handled 245M+ interactions in 2024; voice/text assistant for bills, transfers, transaction details, and proactive insights without exposing data to external LLMs.

• Morgan Stanley — “AskResearchGPT” gives one-click access to 70k+ proprietary reports across IB, S&T, and research for rapid insight retrieval.

• JPMorgan Chase — “Moneyball” acts as a virtual coach for portfolio managers, analyzing decades of data to reduce bias and improve investment decisions.

• Citigroup — Used GenAI to parse a 1,089-page capital rules document, distilling key takeaways for risk and compliance teams.

• Mastercard — AI detects compromised cards faster, scans billions of transactions, reduces false positives, and accelerates at-risk dealer identification.

• Fujitsu & Hokuhoku Financial Group — Pilots GenAI for internal inquiries, document generation/verification, and code creation.

• OCBC Bank — “OCBC GPT” (Azure OpenAI) deployed to 30k employees; tasks completed ~50% faster for writing, research, and ideation.

• Bank of America — Reimagining “Erica” with search-centric design; exploring GenAI capabilities with secure pilots before consumer rollout.

• Deutsche Bank — AI for cash flow forecasting, NER on scanned documents, and intelligent routing; partnerships with Google and NVIDIA.

• NatWest — Upgrading “Cora” with IBM Watsonx for more conversational, personalized experiences from secure information sources.

• BBVA — First European bank to deploy ChatGPT Enterprise to 3,000+ employees for content creation, complex Q&A, data analysis, and process optimization.

• bunq — “Finn” answers natural-language questions on spending and transactions, delivering context-aware insights.

• Raiffeisen Bank — “RBI ChatGPT” (Azure OpenAI + AI Search) summarizes legal/regulatory docs and automates BI documentation to boost productivity.

SECTION: Limitations and Risks of Generative AI in Banking

Limitations

• Data dependency: Biased or incomplete data yields inaccurate outputs.

• Hallucinations: LLMs can produce plausible but incorrect results.

• Explainability: Opaque models challenge accountability and trust.

• Numerical precision: Complex calculations may require human oversight.

Risks

• Bias and fairness: Models can perpetuate unfair outcomes.

• Privacy and security: Sensitive data raises breach and misuse risks.

• Reputational risk: Errors or misuse can erode trust.

• Performance & explainability: Incorrect answers and opaque logic pose operational risks.

• Strategic risks: Potential ESG/regulatory misalignment.

• Third-party risks: Vendor reliance can introduce vulnerabilities.

Mitigation strategies include strong data governance, rigorous testing and validation, transparency and explainability practices, and an ethical AI framework.

SECTION: Future of Generative AI in Banking

GenAI will power virtual assistants for employees and customers, accelerate software development and data analysis, and generate tailored content at scale. Projections suggest productivity gains of 2.8%–4.7% ($200–$340B in revenue) and 27%–35% front-office efficiency improvements by 2026—up to $3.5M additional revenue per employee. Institutions are already deploying pilots; as successes compound, adoption will broaden across functions.